Thursday

September 2021

Direct contact? Call 073 - 44 00 300 or mail to info@wdl.nl.

Thursday

September 2021

Analysis, content and arguments seem to receive less and less attention everywhere in society. So too in the investment world and thus in the investment category: Loans to SMEs and real estate investors.

We have many contacts with investors interested in this asset class. And many of these investors, wealth managers and family offices are sharp to the bone! Beautiful! I love that. But many others also don’t actually understand very well what returns, costs and risk really mean in this asset class. If it only says 10% return per year as a promise, people quickly agree. This, however, without factoring the risks and costs into this rate of return. They are comparing apples to bananas.

Let’s take a closer look at this:

the easiest of the three. An interest rate per year of income. At most, it matters with what periodicity you receive the interest. And whether there are any one-time fees such as exit fees for early repayment. Making an IRR calculation in excel with two or three scenarios often also creates clarity in case of differences in maturity.

There are two elements of interest.

We manage loans professionally using IT and professionalism. Some investors prefer to do it themselves in order to avoid fees. But even that takes time and therefore money. I can tile myself but whether it will be done efficiently and look neat and tidy? I dare to answer. It also makes sense that loans with a 1st mortgage at 60% Loan To Value (LTV) take less time to manage than a loan without collateral. After all, you have excellent comfort in case of payment problems.

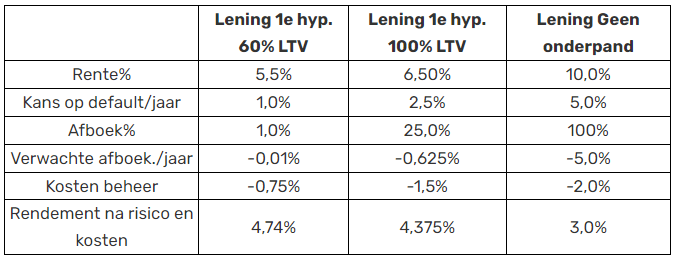

Tabular summary:

10% per year return may be quite different than the “sales brochure” would have you believe. Our advice: dive in! Analyze, question, and test your own conclusions with third parties