Financing for businesses or real estate investments

Because opportunities often exist

Many entrepreneurs have their affairs in order but can't secure a loan. WDL Kredietfondsen helps find financial solutions.

Direct contact? Call 073 - 44 00 300 or mail to info@wdl.nl.

Financing for businesses or real estate investments

Many entrepreneurs have their affairs in order but can't secure a loan. WDL Kredietfondsen helps find financial solutions.

Banks are increasingly focused on internal policies and digitalization, making business financing more challenging.

However, there are plenty of opportunities to finance outside banks. WDL Kredietfondsen offers solutions in areas where banks cannot, such as through our WDL Direct Lending, WDL 1st Mortgage Fund II or WDL High Yield Fund.

Entrepreneurs in the SME sector must always stay active. This requires liquidity to ensure that setbacks never jeopardize business operations. Additionally, it’s important to continue investing countercyclically. Fortunately, today’s entrepreneurs are increasingly aware of the risks and the buffers needed for tougher times.

Financing specialists with understanding."

Rob, 62, Den Bosch

I sent a message, and they called back the same day to assess the situation. Love that speed!

Tom, 29, Oisterwijk

My bank just stopped visiting. But WDL Kredietfondsen does come by just to have a chat."

Henk, 47, Hilversum

At my bank, a 3-month approval process is fast. With WDL Kredietfondsen, I had financing certainty in 2 weeks."

Olivia, 39, Beverwijk

North Brabant

Financing construction home

| Loan | € 1.250.000,= |

| Interest | 8,0% |

| Repayment | No repayment during term |

| Duration | 18 months |

| Collateral | 1st mortgage on OG with an LTV of 43% |

| Liability | Deposit |

Limburg

Refinancing horticultural sites

| Loan | €3,800,000 (divided among 6 investors) |

| Interest | 7,50% |

| Repayment | € 120,000 per year |

| Duration | 60 months |

| Collateral | 1st Mortgage on OG, with an LTV of 61% |

| Liability | Deposit |

South Holland

Financing business property

| Loan | € 450.000,= |

| Interest | 7,50% |

| Repayment | €18,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG, pledge rental payments |

| Liability | Deposit |

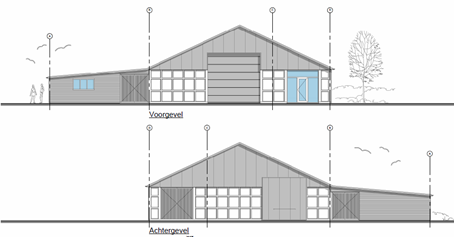

North Brabant

Financing business shed

| Loan | € 900.000,= |

| Interest | 7,50% |

| Repayment | € 27.000,= |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with LTV of 69%, pledge of rental payments |

Drenthe

Funding tool association

| Loan | € 1.200.000,= |

| Interest | 6,75% |

| Repayment | € 37,500 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with LTV of 72%, pledge rental payments |

| Liability | Deposit |

Overijssel

Financing recreation development

| Loan | € 9,000,000 (divided among 28 investors) |

| Interest | 10% |

| Repayment | No repayment during term |

| Duration | max. 18 months |

| Collateral | 1st mortgage on OG with LTV of 66% |

| Liability | Collateral, pledges of movable property, accounts receivable and contracting agreements |

North Brabant

Financing corporate halls

| Loan | € 350.000,= |

| Interest | 6,75% |

| Repayment | € 12,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG, pledge rental payments |

North Brabant

Financing horse farming

| Loan | €75.000,= |

| Interest | 7,50% |

| Repayment | No repayment during term |

| Duration | 5 years |

| Collateral | 1st mortgage on OG |

South Holland

Financing project development

| Loan | €1,100,000 (divided among 6 investors) |

| Interest | 8,5% |

| Repayment | Suddenly at the end of term or upon sale of apartments |

| Duration | Maximum 24 months |

| Collateral | 1st mortgage on OG, pledge rental payments |

North Holland

Financing recreation accommodation

| Loan | € 3,900,000 (divided among 15 investors) |

| Interest | 10% |

| Repayment | Suddenly per end of term or upon sale of lots |

| Duration | Maximum 24 months |

| Collateral | 1st Mortgage on OG with an LTV of 80% |

| Liability | Deposit |

Utrecht

Bridge financing to purchase apartment

| Loan | € 380.000,= |

| Interest | 7,50% |

| Repayment | No repayment during term |

| Duration | 4 months |

| Collateral | 1st mortgage on OG with LTV of 76% |

| Liability | Pledge of rent payments |

North Brabant

Loan refinancing

| Loan | € 875,000 (split between 2 investors) |

| Interest | 7,50% |

| Repayment | No repayment during term |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with LTV of 60%, pledging accounts receivable, inventories and inventory |

North Holland

Financing recreation accommodation

| Loan | € 1.770.000 |

| Interest | 7,75% |

| Repayment | No repayment first 2 years, then €51,000 per year |

| Duration | 5 years |

| Collateral | 1st Mortgage on OG with LTV of 68%, pledge of rental payments |

| Liability | Deposit |

Utrecht

Refinancing office property

| Loan | € 300.000,= |

| Interest | 6,5% |

| Repayment | No repayment during term |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with LTV of 23%, pledge rental payments |

| Liability | Deposit |

North Brabant

Financing working capital

| Loan | € 500.000,= |

| Interest | 7,75% |

| Repayment | 1st and 2nd year grace free. Thereafter € 150,000 per year. |

| Duration | 5 years |

| Collateral | 2nd mortgage on OG with LTV of 76% |

Zeeland

Dairy farm refinancing

| Loan | € 3.150.000,= |

| Interest | 8,0% |

| Repayment | No repayment during term |

| Duration | 3 years |

| Collateral | 1st mortgage on farmland and OG with LTV of 69%, pledge of rental payments |

Drenthe

Refinancing office property

| Loan | €3,250,000 (divided among 4 investors) |

| Interest | 7,75% |

| Repayment | No repayment during term |

| Duration | 24 months, with a minimum interest period of 6 months |

| Collateral | 1st mortgage on the office building with an LTV of 77%, pledging rental payments |

| Liability | Deposit |

South Holland

Financing business property purchase

| Loan | € 350.000,= |

| Interest | 8% |

| Repayment | € 12,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG, pledge inventory and goodwill, pledge rental payments |

| Liability | Deposit |

Flevoland

Financing business location purchase

| Loan | € 450.000,= |

| Interest | 7,5% |

| Repayment | € 18,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with LTV of 60%, pledge rental payments |

| Liability | Deposit |

Limburg

Loan refinancing

| Loan | € 2.000.000,= |

| Interest | 12% |

| Repayment | No repayment during term |

| Duration | 12 months |

| Collateral | 1st mortgage on OG with an LTV of 52% |

| Liability | Deposit |

North Holland

Financing apartment development

| Loan | € 825,000 (split between 2 investors) |

| Interest | 9% |

| Repayment | Redemption at maturity or upon sale |

| Duration | 12 months |

| Collateral | 1st mortgage on OG with an LTV of 77.5%, pledge of rental payments |

| Liability | Deposit |

Zeeland

Refinancing commercial property

| Loan | €6,500,000 (divided among 8 investors) |

| Interest | 8% |

| Repayment | No repayment during term |

| Duration | 2 years |

| Collateral | 1st mortgage on OG with an LTV of 75%, pledging rental payments |

| Liability | Private liability |

Friesland

Financing apartment development

| Loan | € 400.000,= |

| Interest | 8% |

| Repayment | No repayment during term |

| Duration | 2 years with a minimum interest period of 6 months |

| Collateral | 1st mortgage on OG with an LTV of 58% |

| Liability | Private liability |

South Holland

Financing purchase of retail space with workshop

| Loan | € 400.000,= |

| Interest | 7,5% |

| Repayment | € 18,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 80% |

| Liability | Private liability |

North Brabant

Financing recreation complex

| Loan | € 1,250,000 (split between 2 investors) |

| Interest | 8,0% |

| Repayment | € 36,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on leisure complex with an LTV of 71%, pledging inventory, goodwill and other movable property |

| Liability | Deposit |

North Brabant

Financing purchase of equestrian center

| Loan | € 1,260,000 (split between 2 investors) |

| Interest | 7,75% |

| Repayment | €25,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 69%, pledged rental receipts box rental |

| Liability | Deposit |

South Holland

Bridging finance to purchase seaside apartment

| Loan | € 350.000,= |

| Interest | 7,25% |

| Repayment | No repayment during term |

| Duration | 9 months |

| Collateral | 1st mortgage on OG with an LTV of 53% |

| Liability | Private liability |

Gelderland

Refinancing bakery

| Loan | € 350.000,= |

| Interest | 7,0% |

| Repayment | €4,800 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 70%, pledging rental payments |

| Liability | pledge of rent payments |

South Holland

Refinancing corporate warehouse wholesale business

| Loan | € 275.000,= |

| Interest | 7,75% |

| Repayment | € 12,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 85%, pledging rental payments |

| Liability | Deposit |

North Brabant

Financing apartment development

| Loan | € 700.000 |

| Interest | 7,5% |

| Repayment | € 20,000 per year |

| Duration | 24 months |

| Collateral | 1st mortgage on OG, pledge rental payments |

| Liability | Deposit |

North Brabant

Refinancing office property

| Loan | € 140.000,= |

| Interest | 6,75% |

| Repayment | €48,000 per year |

| Duration | 3 years |

| Collateral | 1st mortgage on OG with an LTV of 25%, pledging rental payments |

North Brabant

Financing bridging home

| Loan | € 750.000,= |

| Interest | 7,5% |

| Repayment | No repayment during term |

| Duration | 8 months, with a minimum interest period of 3 months |

| Collateral | 1st mortgage on OG with an LTV of 52% |

| Liability | Deposit |

North Holland

Financing investments + working capital

| Loan | € 875.000,= |

| Interest | 8,0% |

| Repayment | € 42,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 61%, pledging rental payments |

| Liability | Deposit |

Utrecht

Financing property for rental purposes

| Loan | € 350.000,= |

| Interest | 7,5% |

| Repayment | € 14,400 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on the property with an LTV of 80%, pledge rental payments |

| Liability | Deposit |

Gelderland

Financing development 2 apartments

| Loan | € 200.000,= |

| Interest | 7,5% |

| Repayment | €9,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on property with an LTV of 72.7%, pledged rental payments |

| Liability | Deposit |

North Brabant

Financing construction project development

| Loan | € 300.000,= |

| Interest | 8% |

| Repayment | No repayment during term |

| Duration | 12 months |

| Collateral | 1st mortgage on OG with LTV of 50%, |

| Liability | Deposit |

Utrecht

Commercial real estate financing

| Loan | € 600.000,= |

| Interest | 7,25% |

| Repayment | €20,400 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with LTC of 70%, pledge lease agreement |

| Liability | Deposit |

North Brabant

Bridge financing home remodeling

| Loan | € 600.000,= |

| Interest | 8,50% |

| Repayment | No repayment during term |

| Duration | max. 9 months with a minimum interest period of 3 months |

| Collateral | 3rd mortgage on the home with an LTV of 70% after financing |

| Liability | Deposit |

North Brabant

Refinancing hospitality operation

| Loan | € 1,350,000 (divided among 4 investors) |

| Interest | 7,50% |

| Repayment | € 30,000 per year |

| Duration | 36 months |

| Collateral | 1st mortgage on OG with an LTV of 90%, pledge lease agreement, pledge rental agreement, pledge inventory |

| Liability | Deposit |

Gelderland

Financing real estate for development of apartments

| Loan | €800,000 (divided among 3 investors) |

| Interest | 7,50% |

| Repayment | € 20,000 per year |

| Duration | 3 years |

| Collateral | 1st mortgage on OG with an LTV of 69%, pledging rental payments |

| Liability | Deposit |

North Brabant

Financing residential complex for the purpose of housing employees

| Loan | € 450.000,= |

| Interest | 7,50% |

| Repayment | € 12,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 76%, pledging rental payments |

| Liability | Deposit |

North Brabant

Property purchase

| Loan | €250,000 (split between 2 investors) |

| Interest | 7,50% |

| Repayment | No repayment during term |

| Duration | 12 months |

| Collateral | 1st mortgage on home with an LTV of 52% |

| Liability | Private liability |

North Brabant

Refinancing commercial plinth

| Loan | € 650,000 (divided among 3 investors) |

| Interest | 7,25% |

| Repayment | € 24,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 65%, pledging rental payments |

| Liability | Private liability |

Gelderland

Financing real estate for development of apartments

| Loan | € 500,000 (split between 2 investors) |

| Interest | 7,50% |

| Repayment | € 50,000 per year |

| Duration | 24 months |

| Collateral | 1st mortgage on OG with an LTV of 72%, pledging rental payments |

North Holland

Refinancing and remodeling office building

| Loan | € 2.200.000,= |

| Interest | 7,50% |

| Repayment | €48,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 58%, pledging rental payments |

| Liability | Deposit |

North Brabant

Refinancing business premises

| Loan | € 375.000,= |

| Interest | 7,75% |

| Repayment | €25,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on business OG and 1st mortgage on private home together with an LTV of 70% |

| Liability | Deposit |

Twente

Financing industry peer acquisition and working capital

| Loan | € 580,000 (split between 2 investors) |

| Interest | 7,50% |

| Repayment | € 24,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with 67% LTV, pledging rental payments |

| Liability | Deposit |

South Holland

Financing hospitality property

| Loan | € 600.000,= |

| Interest | 7,50% |

| Repayment | € 18,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 72%, pledging rental payments |

| Liability | Deposit |

Utrecht

Financing rental properties

| Loan | € 520.000,= |

| Interest | 7,25% |

| Repayment | €20,800 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 75%, pledging rental payments |

| Liability | Deposit |

Gelderland

Financing business property

| Loan | € 635.000,= |

| Interest | 7,50% |

| Repayment | € 31,800 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on business property with a Loan To Value of 72% |

| Liability | Deposit |

South Holland

Project Funding

| Loan | € 1.000.000,= |

| Interest | 8,0% |

| Repayment | No repayment during term |

| Duration | 24 months |

| Collateral | 1st mortgage on OG, financing 100% of purchase cost, pledge receivables |

| Liability | Deposit |

Friesland

Financing project development

| Loan | € 350.000,= |

| Interest | 8,5% |

| Repayment | €8,000 per lot upon cancellation and remaining amount upon completion of phase I |

| Duration | Maximum 18 months |

| Collateral | 1st mortgage on land, 73% Loan To Cost-Ratio (LTC) |

| Liability | Deposit |

Zeeland

Refinancing and change of zoning and permit

| Loan | € 110.000,= |

| Interest | 7,0% |

| Repayment | No repayment during term |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 50%, pledging rental payments |

| Liability | Private liability |

North Brabant

Enterprise expansion

| Loan | € 200.000,= |

| Interest | 7,75% |

| Repayment | € 10,200 per year |

| Duration | 5 years |

| Collateral | 2nd mortgage on OG with 53% Loan to Value, pledge rental payments |

| Liability | Private liability |

Gelderland

Working Capital Financing

| Loan | € 750.000,= |

| Interest | 7,50% |

| Repayment | No repayment during term |

| Duration | 36 months |

| Collateral | 1st mortgage on property with a Loan To Value of 53% |

Gelderland

Financing loan to grandchildren related to home purchase

| Loan | € 260.000,= |

| Interest | 6,50% |

| Repayment | No repayment during term |

| Duration | 3 years |

| Collateral | 1st mortgage on OG with an LTV of 33%, pledging rental payments |

| Liability | Private liability |

North Brabant

Home and business refinancing

| Loan | € 1,000,000 (split between 2 investors) |

| Interest | 6,75% |

| Repayment | First year redemption-free, thereafter €24,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on rental property and private residence with an LTV of 53%, pledged rental deposits |

| Liability | Private Liability |

Gelderland

Financing housing for housing employees

| Loan | € 170.000,= |

| Interest | 7,0% |

| Repayment | No repayment during term |

| Duration | 36 months |

| Collateral | 1st mortgage OG with an LTV of 57%, pledging rental payments |

| Liability | Private liability |

North Brabant

Bridge funding for residential care residence development

| Loan | € 1.440.000,= |

| Interest | 7,50% |

| Repayment | No repayment during term |

| Duration | 18 months |

| Collateral | 1st mortgage OG with 72% Loan to Value, pledge rental payments |

| Liability | Deposit |

North Brabant

Financing lots for project development

| Loan | € 800.000,= |

| Interest | 8,0% |

| Repayment | No repayment during term |

| Duration | 2 years |

| Collateral | 1st mortgage on plot/ lots with an LTV of 73% |

| Liability | Private liability |

South Holland

Financing combination property hospitality and residential

| Loan | € 450.000,= |

| Interest | 6,75% |

| Repayment | €9,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with 65% LTV, pledge rental payments |

| Liability | Private liability |

North Brabant

Financing sustainability

| Loan | € 225.000,= |

| Interest | 7,0% |

| Repayment | No repayment during term |

| Duration | 2 years |

| Collateral | 1st mortgage on OG with 50% LTV, pledge rental payments |

| Liability | Private liability |

North Holland

Financing portfolio Residential Real Estate

| Loan | € 3.400.000,= |

| Interest | 7,25% |

| Repayment | No repayment during term |

| Duration | 2 years |

| Collateral | 1st mortgage on OG consisting of 5 leased properties, pledge rental payments |

| Liability | Deposit |

Central Brabant

Financing business property

| Loan | € 1.700.000,= |

| Interest | 8,0% |

| Repayment | €100,000.= per year |

| Duration | 3 years |

| Collateral | 1st mortgage on OG with 73% Loan To Value |

| Liability | Deposit |

North Brabant

Financing real estate for the purpose of redevelopment

| Loan | € 270.000,= |

| Interest | 7,75% |

| Repayment | €10,800 per year |

| Duration | 3 years |

| Collateral | 1st mortgage on OG with a Loan to Value of 92%, pledging rental payments |

| Liability | Deposit |

Utrecht

Financing company home with business premises

| Loan | € 310.000,= |

| Interest | 6,75% |

| Repayment | €8,400 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 48.4%, pledge of rental payments |

| Liability | Bail |

North Holland

Financing business property

| Loan | € 630.000,= |

| Interest | 7,00% |

| Repayment | € 30,000 per year |

| Duration | 3 years |

| Collateral | 1st mortgage on commercial property with 70% LTV, pledge rental payments |

| Liability | Deposit |

North Holland

Financing retail

| Loan | € 2,650,000 (divided among 4 investors) |

| Interest | 6,25% |

| Repayment | € 30,000 per year |

| Duration | 3 years |

| Collateral | 1st mortgage on property with 70% Loan to Value, pledge rental payments |

| Liability | Private liability |

South Holland

Financing business units

| Loan | € 275.000,= |

| Interest | 7,0% |

| Repayment | € 12,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage OG with 76% Loan to Value, pledge rental payments |

| Liability | Joint and several liability |

Twente

Project Funding

| Loan | € 500.000,= |

| Interest | 8,0% |

| Repayment | No repayment during term |

| Duration | Maximum 13 months |

| Collateral | 1st mortgage OG and 2nd mortgage on both private residences debtors |

| Liability | Private liability |

South Holland

Financing business property

| Loan | € 1.225.000,= |

| Interest | 6,25 % |

| Repayment | € 60,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on business property with 50% Loan to Value |

North Brabant

Refinancing flower farm/storage areas

| Loan | € 200.000,- |

| Interest | 6,75% |

| Repayment | € 12,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with 28% Loan to Value |

Gelderland

Financing goat farm

| Loan | € 600.000,= |

| Interest | 6,0% |

| Repayment | € 36,000 per year |

| Duration | 5 years |

| Collateral | 2nd mortgage |

| Liability | Real estate |

North Brabant

Financing rental property

| Loan | € 240.000,= |

| Interest | 6,25% |

| Repayment | € 12,000 per year |

| Duration | 3 years |

| Collateral | 1st mortgage OG with 74% Loan to Value |

South Holland

Financing Burger King

| Loan | € 1,700,000 (divided among 3 investors) |

| Interest | 5,25% |

| Repayment | € 55,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage 73% Loan to Value, pledge rental payments |

Noor

Financing enterprise

| Loan | € 650.000 |

| Interest | 6,50% |

| Repayment | € 15,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on commercial OG, 54% LTV |

| Liability | Pledged inventories, receivables and inventory |

North Brabant

Financing caravan storage and storage units

| Loan | € 750.000,= |

| Interest | 6.00% per year |

| Repayment | € 24,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage leased property with 50% LTV, pledge rental payments |

Utrecht

Financing working capital

| Loan | 500.000,= |

| Interest | 7,5 % |

| Repayment | No |

| Duration | 3 years |

| Collateral | 1st mortgage on private residence |

| Liability | Bail 100% |

The Hague

Financing business premises

| Loan | 1.450.000,= |

| Interest | 5,25% |

| Repayment | No |

| Duration | 5 years |

| Collateral | 1st mortgage on commercial properties and apartments with 72.5% Loan To Value, Pledged rental deposits |

Emmen

Refinancing company

| Loan | 700.000,= |

| Interest | 6,75% |

| Repayment | 36,000.= per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with 85% Loan to Value |

| Liability | Bail 25% |

Central Brabant

Financing trading company

| Loan | 500.000,= |

| Interest | 9,00% |

| Repayment | No |

| Duration | 1 year |

| Collateral | 1st pledge of accounts receivable, inventories, inventory and machinery |

| Liability | Joint and several liability |

Rotterdam

Financing residential shopping property

| Loan | € 550.000,= |

| Interest | 5,50% |

| Repayment | 12,000.= per year |

| Duration | 5 years |

| Collateral | 1st mortgage on retail property with 6 apartments with 67% Loan To Value |

| Liability | Private liability |

Northern Limburg

Financing purchase of assets from bankruptcy

| Loan | € 4.500.000,= |

| Interest | 8,75% |

| Repayment | No |

| Duration | 2 years |

| Collateral | 1st mortgage on OG with 60% Loan To Value |

| Liability | Private Liability |

Sint-Oedenrode

Financing hospitality property

| Loan | € 350.000,= |

| Interest | 6,00% |

| Repayment | € 1,000 per month |

| Duration | 5 years |

| Collateral | 1st mortgage on hospitality property with 58% LTV, Pledged rental deposits |

| Liability | Private liability |

Breda

Financing farmland

| Loan | € 725.000,= |

| Interest | 5,50% |

| Repayment | No |

| Duration | 5 years |

| Collateral | 1st mortgage with 40% Loan To Value |

| Liability | Private liability |

Nijmegen

Financing loan to PH

| Loan | € 850.000,= |

| Interest | 6,50% |

| Repayment | No |

| Duration | 18 months |

| Collateral | 1st mortgage on private home with 31% LTV |

| Liability | Private liability |

Noordwijk

Financing business property

| Loan | € 360.000,= |

| Interest | 5,50% |

| Repayment | €15,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage with 80% Loan To Value |

| Liability | Private liability |

Amsterdam

Financing storefront

| Loan | € 1.200.000,= |

| Interest | 6,00% |

| Repayment | €50,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage with 60% Loan To Value |

| Liability | Private liability |

Kerkrade

Commercial building + apartments

| Loan | € 900.000,= |

| Interest | 6,50% |

| Repayment | €30,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage with 55% Loan To Value |

| Liability | Private liability |

Den Bosch

Financing business acquisition

| Loan | € 260.000,= |

| Interest | 8,5% |

| Repayment | € 52,000 per year |

| Duration | 5 years |

| Collateral | Pledged accounts receivable, machinery and inventory |

Eindhoven

Commercial building with apartment

| Loan | € 400.000,= |

| Interest | 5,75% |

| Repayment | No |

| Duration | 1 year |

| Collateral | 1st mortgage with 75% Loan To Value |

| Liability | Borgtoch 25% |

Schijndel

Financing business property

| Loan | € 1.260.000,= |

| Interest | 6,00% |

| Repayment | € 50,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage with 70% Loan To Value |

| Liability | Private liability |

Zeeland

Financing company residence incl. halls and farmland

| Loan | € 965,000,= incl. bridging €360,000.= |

| Interest | 7,75% |

| Repayment | 1st year redemption free, thereafter € 21,000 per year |

| Duration | 5 years, bridging: max. 2 years with a min. interest period of 3 months |

| Collateral | 1st mortgage on OG with an LTV of 63% Collateral for bridging: 2nd mortgage on OG to be sold, 2nd mortgage on private home to be sold |

Zeeland

Financing apartment

| Loan | € 325,000,= incl. € 200,000.= bridge |

| Interest | 7,25 % |

| Repayment | € 2,400 per year |

| Duration | 5 years, part bridging max. 18 months |

| Collateral | 1st mortgage on OG with an LTV of 66%, pledging rental payments |

| Liability | Deposit |

Friesland

Refinancing business properties

| Loan | € 400,000 (split between 2 investors) |

| Interest | 7,75% |

| Repayment | No repayment during term |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 38% |

| Liability | Private liability |

Utrecht

Refinancing garage boxes/units

| Loan | € 300,000 (split between 2 investors) |

| Interest | 7,5% |

| Repayment | €9,000 per year |

| Duration | 5 years |

| Collateral | 1st mortgage on OG with an LTV of 62%, pledging rental deposits garage boxes |

| Liability | Deposit |

Want to learn more about WDL Kredietfondsen? Get in touch with Maykel Hermanussen at 06 57 26 38 44.

Or mail Maykel

12 July 2024

21 May 2024

20 March 2024

27 February 2024

19 December 2023

12 December 2023

4 December 2023

2 October 2023

2 February 2023