Wednesday

April 2022

Direct contact? Call 073 - 44 00 300 or mail to info@wdl.nl.

Wednesday

April 2022

Many DGAs borrow money from their own limited liability company: a smart move?

Many DGAs borrow money from their own limited liability company. The bill to cap this at €700,000 was recently sent to the second chamber. And yes, we also often see it in the financial statements and IB returns we use in financing applications for our clients. DMSs use cash from their limited liability company to finance investment property in Box 3. But it’s still a little weird, too:

Why would you as a private limited company lend money to a DGA for a low interest% when that DGA can also raise it externally for an equally low interest%.

The limited liability company is then left with excess liquidity. But surely that limited liability company can then invest with that and make a higher return than lending it to the DGA?

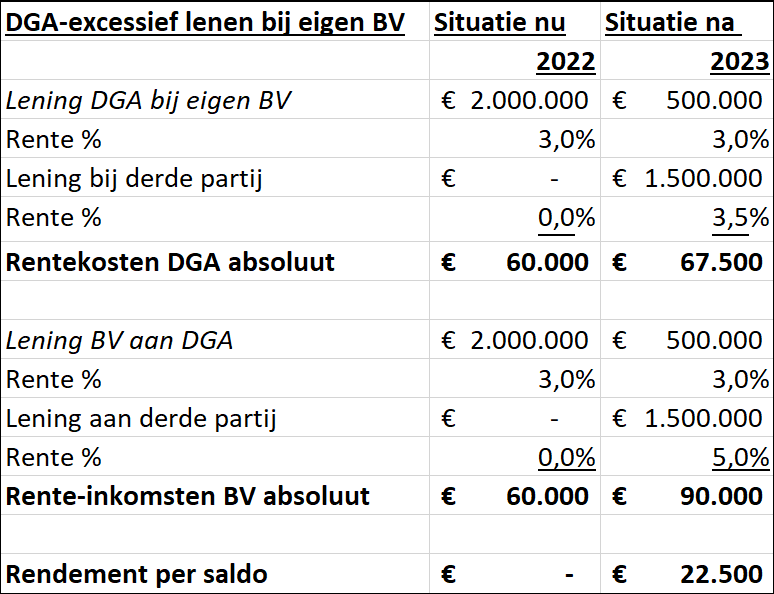

A quick calculation for the variant that the BV will lend the excess cash to a third party under full mortgage coverage. This involves a similar low-risk asset class.

The DGA can borrow externally at similar rates and the limited liability company can lend at better rates. On balance, a significant improvement in returns.

Our conclusion: the BV lends to the DGA: What a bad investment!

Want to know what the options are in your situation? Contact Bart van der Wielen at 06 38 90 43 36.

Or mail Bart