Sunday

June 2023

Direct contact? Call 073 - 44 00 300 or mail to info@wdl.nl.

Sunday

June 2023

In our investment category of business loans, we regularly get the question from investors, "What is the best method to keep the risk on your investment in this category low? Is that spread in a multitude of loans or a 1st mortgage as collateral?" And now I hear you thinking, Both of course!

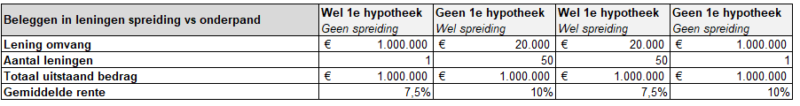

But what methodology actually works best to make a better return, and most importantly, without hassle? Spread or 1st mortgage? Let’s try to look at this more analytically. Suppose you have these 4 situations:

In the table above you can see that all options assume a deployed amount of €1,000,000. In one loan, or in 50 parts of €20,000. The average interest rates mentioned are derived from what we currently see in the market.

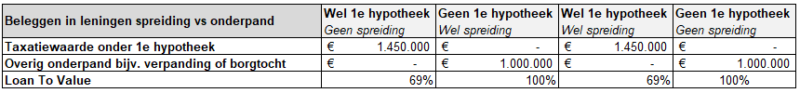

Okay, now to collateral:

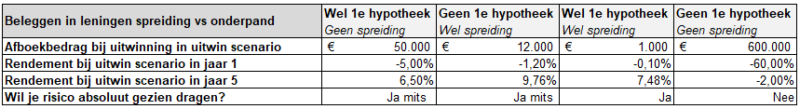

The 69% Loan To Value with a 1st mortgage does not mean that there cannot be a write-off. We are currently seeing all kinds of risks and valuations in the market not only in project finance. Without properly interpreting this as a funder, that 69% still doesn’t say much. A proceeds of € 950,000, = in a foreclosure sale scenario or sale in a foreclosure auction is no exception with a valuation of € 1,450,000. In other words, in this example, you won’t get €50,000 of the loan back. A low LTV does not always say it all. We prefer to focus on healthy cash flow so you don’t have to foreclose. But that’s another blog….

Back to collateral. I mention here €1,000,000 of collateral in the financing without a 1st mortgage. By this we mean collateral in the form of pledging inventory, machinery, accounts receivable and stock, but also, for example, a guarantee from the entrepreneur. Not the best collateral in a foreclosure scenario!

Experience shows that out of this €1,000,000 in collateral, you will get back about €400,000 in a foreclosure scenario. So then you book off 60% of your loan upon foreclosure of the collateral.

Suppose you have 50 loans of €20,000. In any case, a write-off of this 60% on every €20,000 loan is not going to happen. But what part of those 50 loans did? This depends very much on the quality of the selection, the analyses at the loan origination and the management during the loan.

Historically, we know that in a downturn, 1 to 3% of borrowers per year get into trouble. Suppose; we calculate with 2% per year and 60% amortization of your loan and you have sufficient spread. Then, relative to the case with 1st mortgage, the interest rate would have to be about 1.7% higher to compensate for that higher risk of write-offs. In the market we now see differences of 2 to 3% higher interest rates. In the example above, we assume 2.5% higher interest rates. And then, in the spread variant without a 1st mortgage, a better return still results!

And are you curious about the opportunities offered by WDL Credit Funds? Contact Ad Huisman at 06 12 94 86 76.

Or mail Ad