This time just a more professional blog dear readers! In the business finance profession, we always talk about cash flow analysis. We then do this to efficiently determine whether the (potential) borrower can pay its interest obligations and repayment in the future. In this blog, I'll take you through how we perform this analysis with a cash flow table.

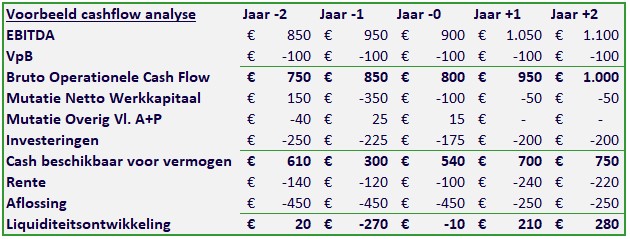

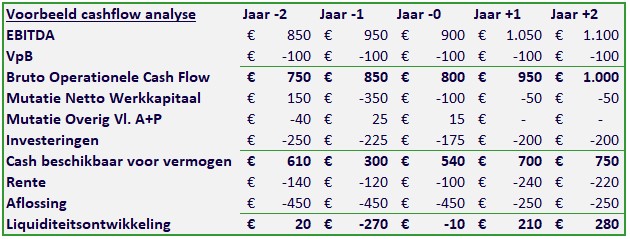

If we assume an SME in a limited liability company, the possible setup of a cash flow table is as follows:

Notes on the table

- Cash flows: In a cash flow table, it is easy to also show positive cash inflows as a positive number, and cash outflows as a negative number. This avoids thinking errors.

- Periodic Developments: By looking at the past two years, the current year and two years ahead, the reader of that table immediately gets a picture of developments through the years/periods.

- EBITDA stands for Earnings Before Interest, Tax, Depreciationand Amortization. So earnings before interest, tax and depreciation. In fact, a company’s profits before a financier, accountant or tax authority gets involved. In other words; the operational engine of the company! That which is within the entrepreneur’s control. For us, EBITDA is the end of profitability analysis and the beginning of cash flow analysis.

- Change Net Working Capital are the changes in inventory, accounts receivable and accounts payable added together. Suppose the stock is at 400 at 31-12-2022 and 500 the following year, then the change in stock is -/- 100. Historically this is purely arithmetic, but in budgets you regularly see this at zero while revenue is growing. This is often unrealistic.

- Change Other Vl. A+P. represents changes in other current assets and liabilities, such as, for example, tax liabilities or receivables, current account management and current account associates.

- Investment or Capex: Companies are always making investments. I am not talking about jump investments, but mainly about the regular replacement investments that a company must make to stay operational. Consider cars, machinery and inventory, for example. Including no investments in budgets is also something we often see, but which of course is not the reality in practice.

Analysis on cash flow table

In this the SME example in the table, the company has a setback in profitability in the current year. No major setback, but still a slight drop in EBITDA. Expectations for current year are back on the old growth path and explainable. Substantial increases in sales caused net working capital in the company to grow substantially. The movement in accounts payable does not fully fund the growth in inventory and the growth in accounts receivable. The company has relatively low interest costs but high repayment pressures. By refinancing, the interest rate becomes substantially higher but the repayment substantially lower, allowing the company to create peace of mind without liquidity pressure. In other words; the borrower can expect to pay its interest and principal in the future.